Irs Form 941 2025 Penalties

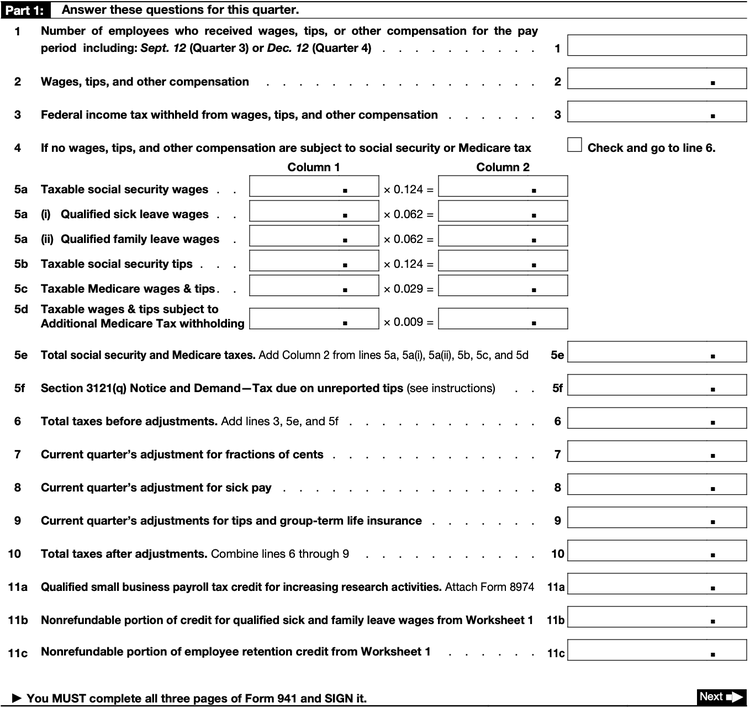

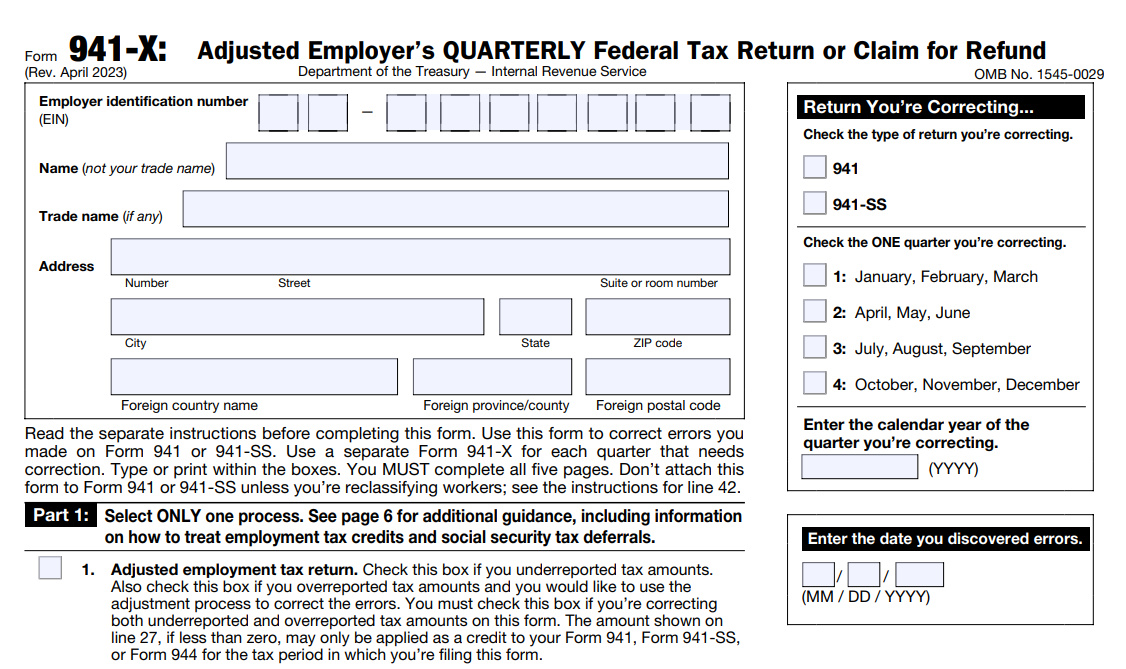

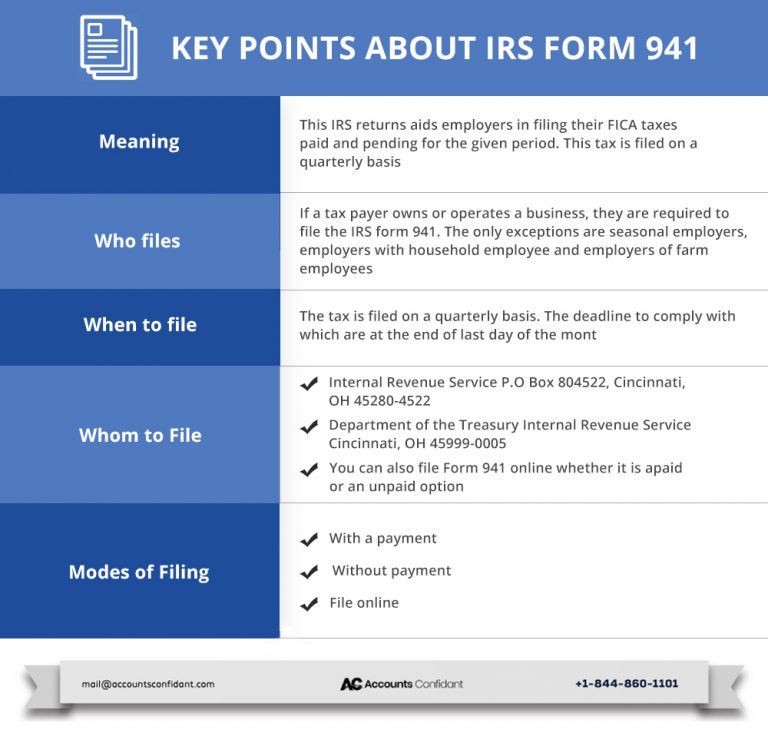

Irs Form 941 2025 Penalties - 941 Forms 2025 Neysa Adrienne, Instead, if you’re eligible to claim the credit for qualified sick and family leave wages because you paid the wages in 2025 for an earlier applicable leave period, file form 941. Here's a general overview of how to calculate penalties and interest: 2025 Schedule B 941 Cammy Corinne, Check out the following topics to know about the penalties. Employers must ensure that they submit form 941 by these deadlines to avoid penalties or fines.

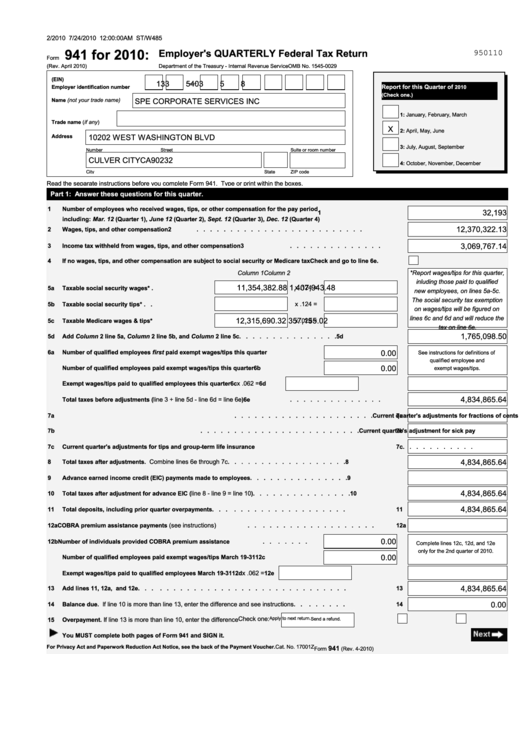

941 Forms 2025 Neysa Adrienne, Instead, if you’re eligible to claim the credit for qualified sick and family leave wages because you paid the wages in 2025 for an earlier applicable leave period, file form 941. Here's a general overview of how to calculate penalties and interest:

Printable 941 Quarterly Form Printable Form 2025 vrogue.co, Late deposit penalties can range from just two percent to over fifteen percent. Your business’s penalty will be five percent of the entire amount.

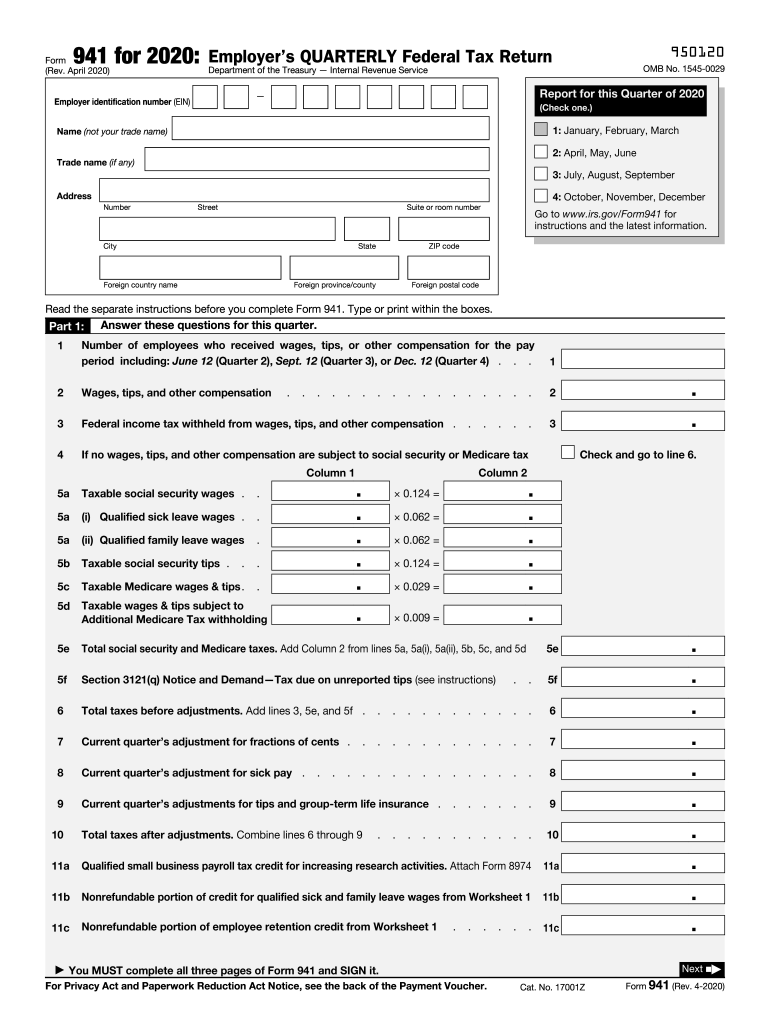

What is IRS Form 941?, Learn everything about irs form 941, including filing requirements, deadlines, and tips to ensure compliance for your business. What are the penalties for late filing?.

Form 941 penalties can vary considerably based on how late you file.

If you need a little extra motivation to help you complete and file your q1 form 941, these potential irs penalties might be the inspiration you need!

The deadline to file form 941 for q2 of 2025 is july 31, 2025.

Schedule B Form 941 For 2025 Gwen Pietra, This allows the ftp penalty and interest to properly compute systemically. Instructions for filing form 941.

941 For 2025 Employers Quarterly Andra Blanche, Check out the following topics to know about the penalties. If you do not file your form 941 return or do not pay the required taxes within the deadline, the irs will impose penalties.

IRS Form 941 Penalties and How to Avoid Them Blog TaxBandits, Instructions for filing form 941. Late deposit penalties can range from just two percent to over fifteen percent.

File 941 Online How to EFile 941 Form for 2025, Form 941 penalties can vary considerably based on how late you file. The penalty for a failure to file form 941 (if required) is 5% of the tax due with the return.

941 20202025 Form Fill Out and Sign Printable PDF Template, Late deposit penalties can range from just two percent to over fifteen percent. Stay vigilant, file on time, and ensure accuracy to avoid unnecessary financial burdens.

IRS Form 941 Meaning, Instructions and Tips AccountsConfidant, Employers must ensure that they submit form 941 by these deadlines to avoid penalties or fines. If the deadline lands on a weekend or a federal holiday,.

It is essential to file your itr before this deadline to avoid penalties and. If you miss this deadline, you can still file a.

Irs Form 941 2025 Penalties. If you need a little extra motivation to help you complete and file your q1 form 941, these potential irs penalties might be the inspiration you need! Here, we'll go over the details of form 941 and how to file the return with the irs.